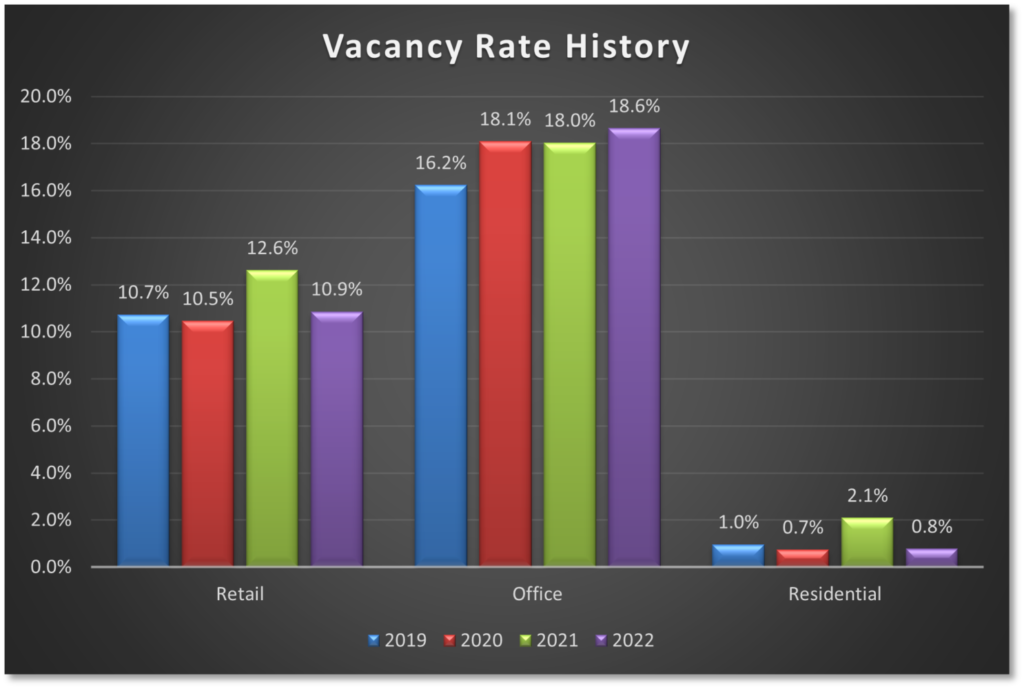

I’ve been following the real estate market in downtown Kalamazoo for over 10 years, measuring the vacancy levels every March by surveying property owners and visually inspecting properties. While some may disagree with one aspect or another of my methodology, I use consistent standards so that we can track the trends over time. This consistency is what makes it a useful study.

Office

Surprisingly, the office vacancy rate held steady despite losing several large tenants and adding the Warner Building to the market. The growth seems to be primarily in the smaller office market, as local businesses and non-profit agencies expand or relocate into downtown Kalamazoo.

Major changes:

- The Warner Building added 123,000+ square feet of office space, all of it full.

- Several relocations created large vacancies. Historically, downtown does not absorb large office suites quickly.

- Roughly 14,000 square feet of office space was removed from the study when two buildings were purchased by Zoetis and Bronson, respectively; this study does not include institutional properties.

- The Hospice Care space was filled immediately, saving 16,000 square feet of space from adding to the vacancy rate.

- The 14,000 square foot Regus space was filled with Arcadia Suites, a similar concept that is owned by PlazaCorp and marketed by Dover Birch.

Key learnings:

- Smaller office suites are faring better than larger suites.

- While vacancy rates remain high, asking rental rates have not dropped, especially for the smaller-format office suites.

- Over half of the office vacancy is in just six buildings, and most of that is in suites larger than 10,000 square feet.

- Building owners who solve the parking issue seem to be faring better than those who ignore it.

Retail

In this study, retail includes retail stores, salons, and restaurants, but not banks or other first-floor office users. A large chunk of downtown’s retail space is along the Kalamazoo Mall.

Some key points include:

- The Mall recovered somewhat in the last year, though there are notable vacancies that affect people’s perception of how vibrant it is.

- Three significant office users take up a large chunk of the Kalamazoo Mall frontage.

- The Mall vacancy rate is similar the overall downtown vacancy rate, at roughly 11%. Last year it was several percentage points higher.

- We lost fewer restaurants than anticipated, partly due to government programs aimed at keeping them afloat during the pandemic. A lack of employees willing to work restaurant-type hours and wages his slowing growth in this industry.

Upcoming changes:

- There are potential projects coming to East Michigan Avenue that could transform that part of downtown.

- At the time of this study, Food Dance is still open and their 10,000 square feet is counted as occupied retail space. Could another concept be in the wings to take that large of a space?

Residential

Even after adding 280 new apartments in 2020, the residential market has fully recovered. Today, virtually every residential unit is filled, and most landlords have a waitlist.

Upcoming Changes:

- Hinman/AVB are adding another 110 units to 400 S Rose Street.

- Other residential projects are being considered; they are currently on hold while developers wait for the construction prices to come back down.

Conclusion

Downtown Kalamazoo’s real estate market is surprisingly healthy, despite the aggressive growth in residential units and loss of major office and restaurant tenants. It’s quite possible that we are under-selling the potential of downtown Kalamazoo.