People remember 2008 like it was yesterday, and some are saying that we’re in a housing bubble that will cause prices to fall. I’m not so sure.

Today’s price increases are driven by two primary factors: demographics and low inventory.

Demographics

Not only are Millennials coming of homebuying age (43% of home purchases are from Millennials, up from 37% last year), but Gen Xers are using their newfound home equity and pandemic-related stimulus dollars to move up, according a report from the National Association of Realtors (NAR).

Add to that the largest year-over-year increase in wages in recent memory and low (though rising) interest rates, and homeownership becomes attainable for more people, at least in the middle- and upper-income brackets.

Low Inventory

The low inventory is driven by fifteen years of underbuilding, resulting in a shortage of at least 5.5 million homes in the US, according to NAR. We would need to increase new housing starts by 60% to fill the gap, and homebuilders seem shy about building homes on speculation. They seem to remember 2008 quite well.

The labor shortage and elevated materials cost mean that this won’t be an easy issue to solve.

Factors to Watch

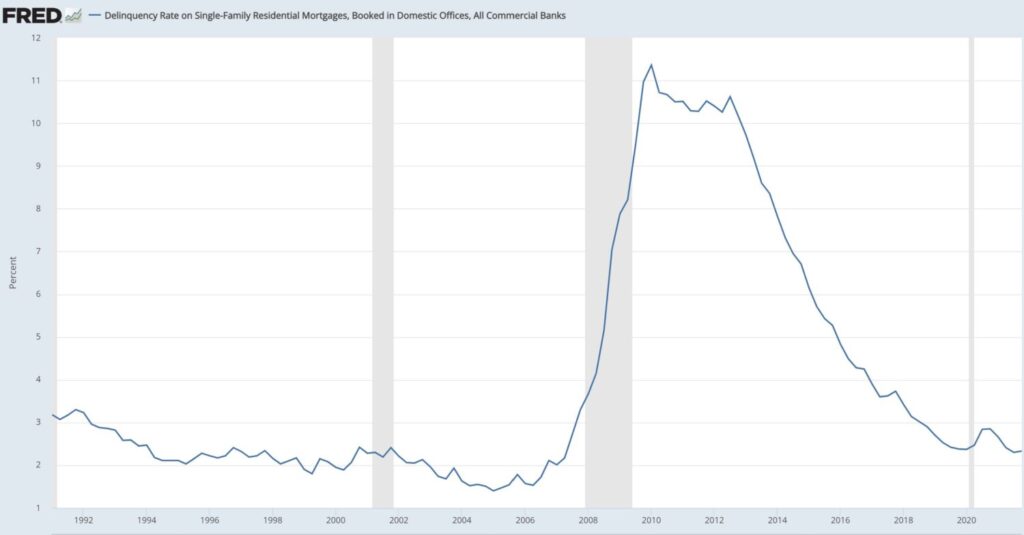

Watch the delinquency and foreclosure rates. While foreclosures didn’t spike after the moratorium ended in December 2021, we are still early in this new “normal.”

Also watch interest rates. The Mortgage Bankers Association predicted that interest rates would hit 4% by the end of 2022; they are already at 5%. That one percentage point difference is a $125 increase in monthly mortgage payments on a $200,000, 30 year loan.

Mortgage Delinquency Rates